Complete HR Outsourcing:

From Payroll to Global Talent

Scale your business confidently while we manage payroll, compliance, recruitment and international expansion.

What SBS HR Offer

Statutory Compliance

End-to-end regulatory management including

filings, registers and government submissions

so you stay compliant effortlessly

Global PEO | EOR Services

Expand globally with ease—onboard

international employees, handle compliance,

payroll and contracts without setting up local entities.

What You Get With

One Partner

100% Accurate &

On-Time Payroll,

Every Single Month

Complete Statutory

Compliance - Zero

Penalties

Fast,

High-Quality

Talent Acquisition

Global PEO & EOR

to Hire Anywhere,

Instantly

Dedicated HR,

Payroll & Compliance

Specialists

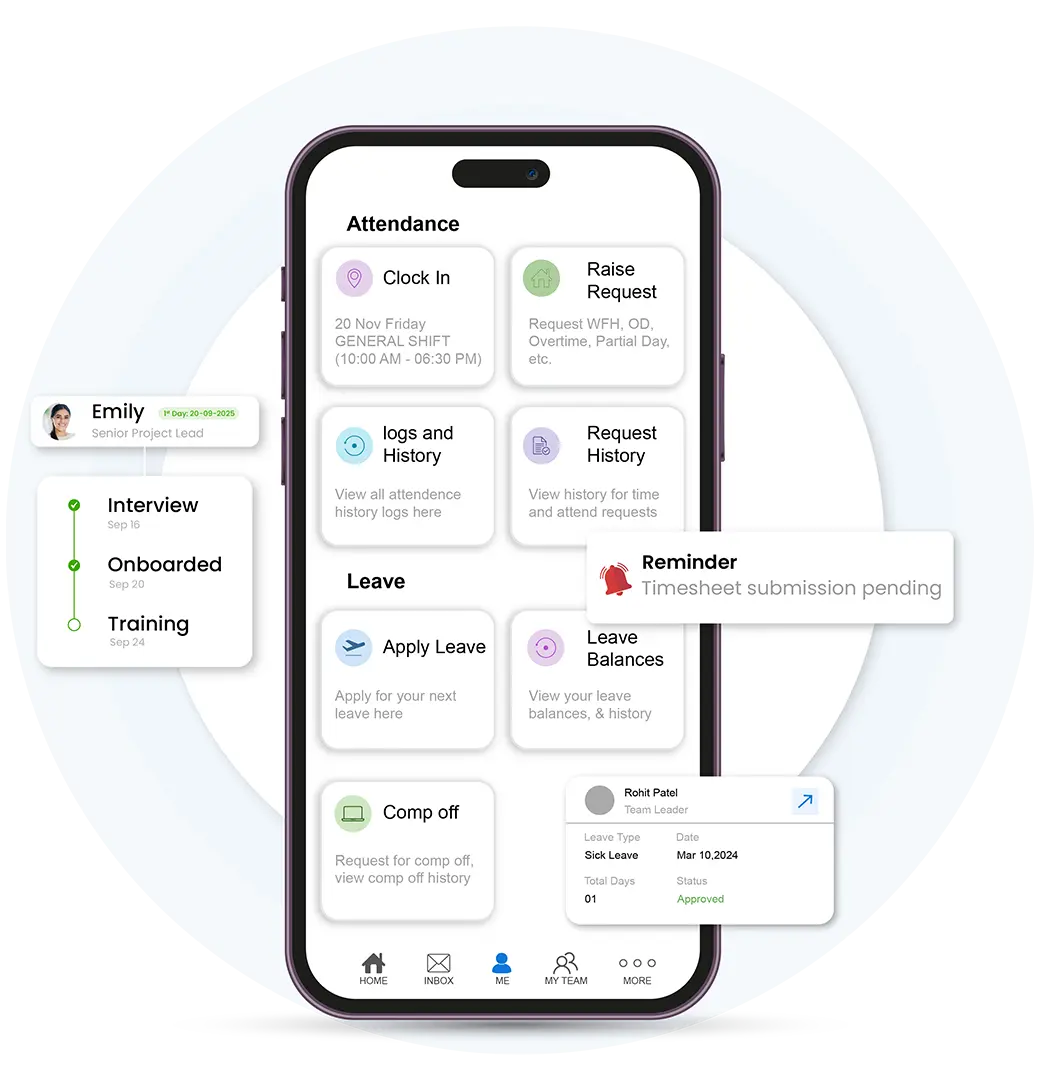

Secure & Scalable

Tech-Driven

HR Operations

Our Achievement

Our track record reflects our commitment to precision and accountability. SBS HR has achieved 99.9% payroll accuracy and 100% statutory compliance for clients across diverse industries and locations, earning long term trust through reliable execution, timely filings, and consistent service excellence.

Proven Payroll Accuracy

Clients

Experience

Per Month

Client Testimonials

Hear directly from the businesses that trust SBS HR to manage their payroll, HRMS, and compliance with precision. Real stories of accuracy, reliability, and exceptional service delivery.

We are very happy with the services provided by SBS HR for our payroll and compliance. The process has been running smoothly for the last three years, and we truly appreciate the consistent support.

The payroll team has consistently demonstrated an excellent commitment to ensuring that all salary disbursements are accurate and timely. Their attention to detail and proactive approach to resolving employee queries quickly have significantly contributed to building trust across the organization.

Our HRMS Partners

We are proud to collaborate with leading HR technology and industry partners who strengthen our service ecosystem. Together, we deliver seamless HR, payroll, and compliance excellence for our clients.

From Payroll Chaos to Clarity.

100% Compliance Guaranteed

- No Delays

- No Penalties

- No Hiring Struggles

- No HR Chaos

Frequently Asked Questions

SBS HR offers complete HR solutions including payroll outsourcing services, statutory compliance, HR technology implementation, talent acquisition and global PEO/EOR services to support business growth.

A full range of HR services under one roof (payroll, compliance, talent, PEO/EOR, training). Emphasis on combining technology (partners with Zoho, GreytHR, Keka, Adrenalin) with human expertise

Outsourcing to SBS HR ensures 100% accuracy, timely disbursements and error-free legal deductions. You save time, reduce compliance risks, and focus fully on business growth.

SBS HR’s payroll outsourcing ensures 99.99% accuracy payroll processing through automation and expert review. Companies achieve significant cost reductions by reducing internal human resources effort, software expenses, and compliance penalties.

Yes, we manage payroll services and statutory compliance across all 18 Indian states, each with unique rules. Our integrated process keeps everything consistent, compliant, and easy to track.

We manage PF, ESI, PT, TDS, CLRA, Shops & Establishment, labour filings, audits, and registrations. Your organisation stays legally compliant without chasing multiple departments.

SBS HR cuts HR costs by automating payroll, compliance and documentation processes, reducing the need for large internal teams. Our streamlined workflows reduce errors, maintain 99.99% accuracy and penalty risks – saving your organization significant money every month.

- Payroll OutsourcingPayroll Outsourcing

- Talent AcquisitionTalent Acquisition

- Statutory ComplianceStatutory Compliance

- Global PEO | EOR ServicesGlobal PEO | EOR Services

- Our BlogOur Blog

- HR TemplatesHR Templates

- SitemapSitemap

- About UsAbout Us

- Contact UsContact Us

- Find JobsFind Jobs

- CSRCSR

-

Sales Enquiry: +91 89259 27076

-

For Job Enquiry: +91 82486 03617

-

For Sales Enquiry: sales@sbshr.com

-

For Job Enquiry: talentacquisition@sbshr.com

Our Services

- Payroll OutsourcingPayroll Outsourcing

- Talent AcquisitionTalent Acquisition

- Statutory ComplianceStatutory Compliance

- Global PEO | EOR ServicesGlobal PEO | EOR Services

Company

- About UsAbout Us

- Contact UsContact Us

- Find JobsFind Jobs

- CSRCSR

Resources

- Our BlogOur Blog

- HR TemplatesHR Templates

- SitemapSitemap

Talk to Sales

-

+91 89259 27076

-

sales@sbshr.com

For Candidates

-

+91 82486 03617

-

talentacquisition@sbshr.com